Lessons Learned: Operationalizing the new ASC 842 lease accounting standard

Summary

The Financial Accounting Standards Board (FASB) issued ASC 842, essentially eliminating the concept of off balance sheet financing and requiring publicly traded, privately held and not-for-profit organizations to recognize equipment and real estate type leases as assets and liabilities on the balance sheet. To address this major change, leading organizations are designing steps to achieve sensible business benefits to augment activities required for ASC 842 compliance.

To be compliant, ASC 842 requires substantial operational changes throughout the lessee’s organization due to the decentralized nature of operating leases involving many global sites and corporate functions, and most significantly impacting accounting and IT activities. Publicly traded companies must adhere to ASC 842 for fiscal years beginning after December 15, 2018. Non-profit organizations and privately held entities generally have one extra year to adopt.

The following key questions will be addressed in this review:

- What is changing with the new Lease Accounting regulation?

- What are the complications impeding organizations from being compliant with ASC 842?

- Where are the key lease accounting transition issues?

- Why is the data gap a primary issue facing organizations?

- Why is ownership a complication for lease accounting?

- Why improving the process may make good business sense for an organization?

- How are organizations structuring their approach for identifying all the lease contracts and becoming compliant?

- Five keys to start a successful adoption program

- What are the benefits that organizations can expect to achieve as an outcome of the project?

- How can Tartan Advisors help your team?

- Contact information to schedule a follow-up conversation

What is changing with the new Lease Accounting regulation?

ASC 842 impacts both lessor and lessee accounting, but changes for lessee accounting are more significant. The core principle of ASC 842 is that a lessee should recognize the assets and liabilities that arise from leases and record a right-of-use asset and liability on the balance sheet for both operating and finance leases. This is a substantive change from prior GAAP pronouncements. A comprehensive description of the definitive accounting changes for ASC 842 are at fasb.org.

What are the complications impeding organizations from being compliant with ASC 842?

This major accounting change has enterprise-wide implications that are significant but addressable. Key challenges include the ability to collect data from multiple operations across the globe, ensure completeness and quality of data to be compliant, staff the effort with a complementary blend of internal and external resources, complete the project in advance of a fixed date, design a new enterprise-wide lease accounting process, potentially select new software and coordinate across a wide and diverse stakeholder group.

At many organizations, for example, the equipment leasing decisions can reside at the business unit, division, group or department level. It is rare to have such operating lease contracts centralized and consistently managed. As a result, the data for equipment leases is often incomplete, missing and/or of uncertain and inconsistent quality. Real estate and fleet management resources, on the other hand, tend to be managed at both regional and corporate locations, thereby allowing this data to be more accessible to the program team.

Organizations identify these typical complications and impacts in their efforts to be compliant with ASC 842.

Bloomberg reports more than 85% of the $3.3 trillion in lease obligations globally is off balance sheet.

Figure 1

Traditionally, most accounting change projects have been managed within the walls of the accounting organization. Lease accounting is different being that in most organizations lease accounting decision-making is typically decentralized across the global enterprise. Consequently, lease accounting program leaders are highly dependent on people from multiple functions throughout the business to help identify and capture all required lease data to be compliant for Day 1.

Figure 2

Where are the key lease accounting transition issues?

Timely access to complete leasing data often is the top challenge for organizations arising from disconnects associated with fragmented technology, numerous stakeholders and decentralized processes.

Figure 3

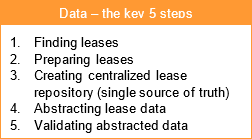

Where’s the data?

This is the #1 question among program leads as organizations embark on scoping the project. Effectively executing a methodical 5-step process helps organizations resolve the data complication.

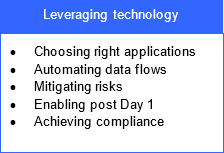

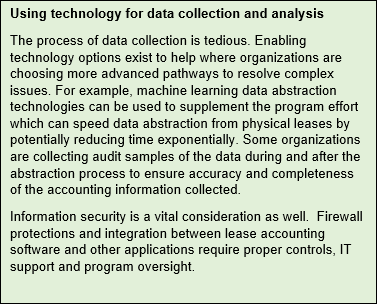

How can technology be leveraged?

Getting IT buy-in and engagement is vital to ensuring the lease accounting solution is compliant, sustainable and efficient over time. Organizations are finding that leveraging purpose-built technology and abstraction tools enhance compliance, documentation and audit support.

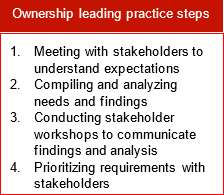

What are the needs and priorities of the stakeholders?

First step is understanding the expectations of all stakeholders. As needs become clear among stakeholders, ownership and priorities among the cross-functional groups emerge - these form the foundation for the program. Identifying a strong program manager is a must for an effective and integrated program. Considering the breadth of stakeholders impacted, organizations are choosing to maximize business value – beyond compliance - from the program.

Who owns the leasing processes?

Since leasing is an inherently cross-functional area, there are multiple process owners. When authority, accountability and responsibility for a process reside in multiple places, mistakes are bound to happen. Consequently, well-designed procedures to enable compliance with the policy need to be clearly developed and articulated. Having a disciplined actionable approach is essential.

Why is the data gap a primary issue facing organizations?

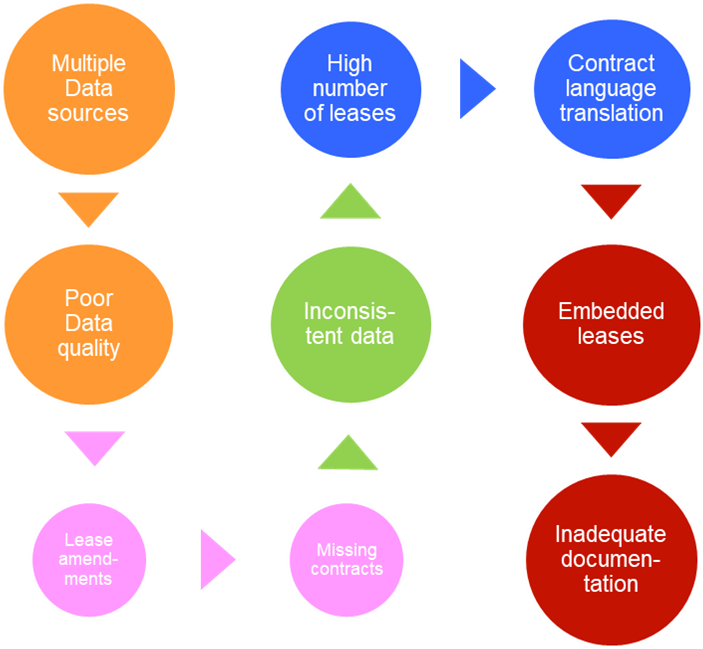

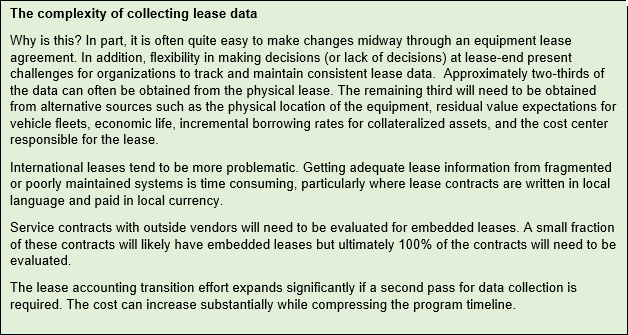

One of the primary challenges with the management of lease accounting data is the fact that there are typically more than 100 fields of required information from each real estate, fleet and equipment contract. Due to the decentralized nature of how equipment lease decisions are made and where these contracts reside in the organization, the data gap for equipment leases tends to be the greatest. Real estate and fleet data, on the other hand, are typically more accessible to the program team yet often still incomplete for lease accounting purposes. The sources of complexity with comprehensively and accurately collecting proper lease data stem from multiple areas and can be summarized in the following illustration:

Figure 4

How can technology help with lease accounting?

Given the complexities and data demands of the ASC 842 requirements, it is generally advisable and in many cases necessary to secure lease accounting software capabilities either in-house or from an external vendor. An IT assessment should be performed early, along with a corresponding RFP and software selection, if necessary, to identify the best fit for the organization’s needs. If an external software option is preferred, it is best to select the software vendor before beginning the data collection process, since each vendor has slightly different data requirements. The choice of lease accounting software vendor and data requirements are interdependent.

Figure 5

Why is ownership a complication for lease accounting?

Lease ownership in any organization is often complicated, primarily with operating leases. In most large organizations under existing accounting policy, the structure, management and accountability for capital leases (e.g., real estate and heavy machinery) may be mature and well defined. However, the structure and accountability within organizations can be wildly divergent and inconsistent for operating leases. Many operating leases for equipment are often done at the local or site level. For global organizations this often means having contracts in local languages. And under current accounting rules these operating leases are off-balance sheet transactions. Consequently, the consistency of record-keeping and data integrity of many operating lease contracts differs, and current practice is often insufficient for proper oversight and formalized consistent process flow needed to comply with ASC 842. An added complication is that there are multiple functions and stakeholder groups impacted by the transition to ASC 842: Accounting, IT, Procurement, Real Estate, Fleet and Asset Management, Internal Audit, Treasury, Tax, and Legal as well as operations at each site, division and data center. Other stakeholders may include Board members and management working with compensation plans, credit rating agencies and banking relationships involving debt covenant compliance.

Why improving the process may make good business sense for an organization?

Many organizations have not established consistent processes and controls in place for leased equipment. As noted, often this is due to the diverse and decentralized nature of operating lease activity. These practices, however, are no longer acceptable to support the new requirements and there is potential risk exposure to the organization. Studies suggest few entities effectively track equipment that is coming off lease in the immediate future, nor do they notify lessors properly to renew, return or purchase the equipment. Even fewer entities track equipment during the lease contract across locations and functions which can lead to inaccuracies in insurance coverage, lease compliance, taxing, accounting and decision-making. With ASC 842, a more thorough lease accounting process can be designed and compliantly executed across sites and functions to consistently and appropriately control and manage leased assets, potentially saving wasted time, effort and money.

How are organizations structuring their approach for identifying all the lease contracts and becoming compliant?

To “find” all leases in an organization, a best practice involves employing both top down and bottoms up approaches.

- Top Down – conduct interviews with business leaders across the global organization to identify potentially hidden sources of leasing contracts

- Bottoms Up – extract detailed transactional data from the general ledger, asset management and accounts payable systems to collect leasing details

Five keys to start a successful adoption program

What are the benefits that organizations can expect to achieve as an outcome of the project?

Project benefits and outcomes will vary at every organization. The main objective is compliance with ASC 842. However, many organizations are seeing benefits beyond compliance. The following table illustrates a short list of typical benefits that can potentially be realized with the lease accounting transition program.

Figure 6

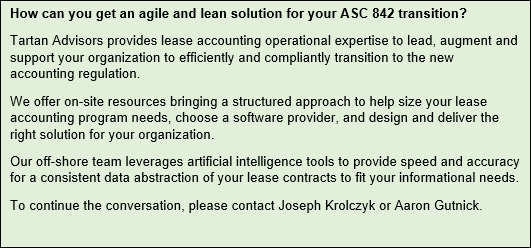

How can Tartan Advisors help your team?

Your organization must prepare and adequately plan to address the changes required with the new lease accounting regulation ASC 842. As the deadline for compliance is rapidly approaching, getting started earlier is usually better than later. Tartan Advisors is available for a conversation. We tailor our effort and role to best meet your needs.

1. Planning the project

- Scope the size and complexity of the effort to support project budget and timeline

- Understand and document expectations across all stakeholder groups

- Formulate the business case with the organization

2. Selecting lease accounting software and abstraction tools

- Lead RFP process for selection of proper software and enabling tools

3. Managing the project

- Design detailed project and communication plans

- Offer proven methodologies, tools and techniques to manage project and reduce risks

4. Abstracting data from lease databases and hard copy documents

- Leverage on-site as well as our off-shore resources in Israel using advanced analytical and AI tools to abstract data

- Create centralized database to track and control information

5. Developing new global leasing processes, procedures and controls

- Update new organizational responsibilities for leasing

6. Deploying the program and training the employees

- Provide post deployment hypercare support